Market Commentary: Natural Gas is Not Just a Bridge Fuel

- Yves Siegel

- Sep 25, 2024

- 11 min read

MIDSTREAM AND UTILITIES OUTPERFORM DESPITE ENERGY’S YEAR-TO-DATE UNDERPERFORMANCE

As of this writing on September 17th, midstream energy has outperformed the S&P 500 year-to-date (up 22% as measured by the AMNA Index) despite low crude oil and natural gas prices and utilities are the best performing sector in the S&P 500 (up 24% as measured by the S&P 500 Utilities Index). This compares to ~18% for the S&P 500.

In contrast, the broad energy sector (up 4.5%) is the worst performing S&P 500 sector. Interesting to note that energy’s underperformance is primarily attributable to the impact of commodity prices on the exploration and production sector. S&P Oil & Gas Exploration & Production Select Industry Index was down -4.1%! Earlier this month, WTI crude oil prices fell below ~$70 per barrel (Bbl) to its lowest level since December 2021.

The recent pullback is attributable to weaker Chinese oil demand, rising non-OPEC production, and possibility that OPEC + will begin to reverse its voluntary production cuts.

We view midstream companies and utilities as defensive investments and are attracted to their relatively high yields, ~6% and ~3%, respectively. Midstream provides the essential infrastructure to the oil and gas industry and is a beneficiary of record U.S. oil production and exports, and utilities are poised to do well with the anticipated growth in power demand.

As for the traditional oil and gas companies, despite subdued oil prices and low natural gas prices, we are still constructive on the sector. The balance sheets of these companies have never been stronger. The companies generate free cash flow enabling them to return cash to shareholders in the form of attractive dividends and share repurchases. Finally, valuations are attractive on an absolute basis and relative to the price to forward earnings multiple of 22x for the S&P 500. The S&P energy sector trades at just ~12 times earnings and a free cash flow yield of ~7%.

Commodity Prices Year-to-Date

Source: The Energy Information Administration

NATURAL GAS IS NOT JUST A BRIDGE FUEL

Natural gas is not just a bridge or transition fuel. We are very bullish on the role that it can play in providing affordable, reliable and relatively clean energy to the world. Additionally, natural gas can help lift the more than 1.2 billion people out of energy poverty, as estimated by the World Bank.

SAM’s Infrastructure Income and Energy Transition strategies favor companies leveraged to advantageous natural gas fundamentals. Recently, we hosted a Fireside Chat with the CEO, Toby Rice and CFO, Jeremy Knop of one such company: EQT Corporation (EQT- NYSE), the largest producer of natural gas in the United States. In this market commentary, we’ll dive into some of the key ideas from our chat.

EQT’s Favorable Outlook on Natural Gas Demand

The long-term outlook for natural gas is very exciting given the expected doubling in liquefied natural gas (LNG) exports toward the end of this decade coupled with the surge in power demand led by data centers. (See our market commentary "The Energy Sector is an Artificial Intelligence Beneficiary"). Toby Rice famously coined the phrase “Unleashing LNG” to highlight the point that substituting natural gas for coal can go a long way toward global decarbonization. The U.S has the resource base but is hindered from producing and exporting more natural gas by cumbersome regulations and the need for permitting reform. (See our market commentary "EQT Chief on Unleashing U.S. LNG").

Biden Administration’s LNG pause has not impacted current LNG projects but has slowed the signing of new contracts, damaging the U.S.’ reputation as a reliable supplier of energy to the world. Toby vehemently believes that U.S. natural gas must be part of the solution to reducing greenhouse gas emissions (GHG) and helping to reduce worldwide energy poverty. We believe that not enough attention has been paid to the progress the energy industry has made in reducing its Scope 1 and 2 GHG emissions. EQT has been a leader in these efforts—specifically, the company achieved its emission intensity targets a year ahead of schedule and is on track to achieve net zero by 2025.

EQT’s Path to Net Zero

Notes: 1. GHG emissions intensity and net zero values and targets are based on assets owned by EQT on June 30, 2021 (i.e., when EQT announced its emissions targets), and thus, exclude emissions and production from the assets acquired from Alta Resources and Tug Hill/XcL Midstream, which occurred after such date. Methane emissions intensity values and target include emissions and production from the assets acquired from Alta Resources and Tug Hill/XcL Midstream. Scope 1 emissions included in the GHG emissions intensity and net zero values and targets are based exclusively on emissions reported to the U.S. Environmental Protection Agency (EPA) under the EPA's Greenhouse Gas Reporting Program (Subpart W) for the onshore petroleum and natural gas Production segment. 2018 and 2019 GHG emissions data does not include Scope 2 GHG emissions, as EQT began calculating its Scope 2 GHG emissions in 2020. Methane emissions intensity, and corresponding methane emissions intensity values and target, is calculated in accordance with the methodology maintained by ONE Future. 2. Reductions through 12/31/2023 includes impact of large-scale developments, replacing diesel powered completions crews with electric crews and pneumatic device emission reductions. 3. EQT-generated carbon offsets may be supplemented with purchased carbon credits.

Source: EQT Investor Presentation – Second Quarter 2024 Results – July 23, 2024

Management expects natural gas to continue to grow its market share of power generation

Industry observers expect a surge in power demand after more than a decade of no growth. Specifically, EQT projects 75 gigawatts of incremental power demand by 2030 driven by data centers and artificial intelligence, electric vehicles, industrial load, and coal-to-gas switching. This could drive an additional 6-13 Bcf/d of natural gas supply to satisfy this growth in demand. For perspective, electric power demand for natural gas averaged 35.4 Bcf/d in 2023, according to the Energy Information Administration (EIA). EQT is well positioned to meet the anticipated incremental natural gas demand from data center hubs in Virginia, Ohio, and along the east coast given its large inventory of drilling sites, low operating costs, and pipeline egress.

Material U.S. Gas-Power Demand and Load Growth 1

Notes: 1. Sources: EIA and EQT research. Bcf/d calculated using 7 MMBtu/MWh heat rate.

Source: EQT Investor Presentation – Second Quarter 2024 Results – July 23, 2024

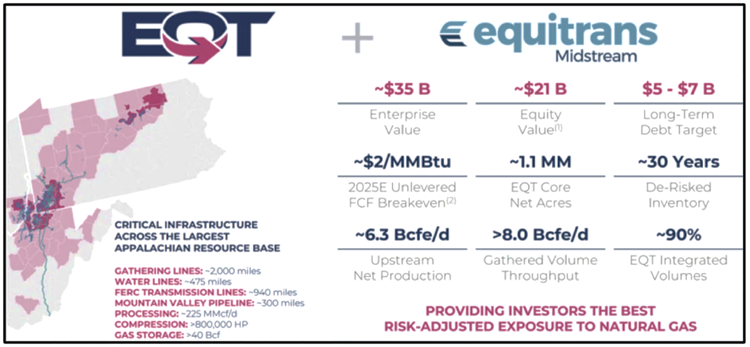

EQT CORP: PROVIDING INVESTORS THE BEST-RISK ADJUSTED EXPOSURE TO NATURAL GAS

EQT transformed into America’s only large-scale, vertically integrated natural gas business after its acquisition of Equitrans Midstream Corporation (ETRN) in July, which also marked the five-year anniversary since CEO Toby Rice and his team took over the helm of EQT after wagering a successful proxy fight. The Rice team has successfully transformed EQT through a series of acquisitions, intense focus on operations, improvement in drilling efficiencies, and capital discipline execution. Along the way, Toby has been championing natural gas as a fuel to reduce global CO2 emissions and help lift developing nations from energy poverty.

EQT Expects Natural Gas Price Volatility

U.S. natural gas infrastructure, pipelines, and storage have not kept up with the 50% increase in natural gas demand since 2010. Storage capacity has grown by just 12%. It is not an adequate buffer to accommodate swings in natural gas demand and supply. Hence, natural gas prices may continue to be volatile.

Natural gas may trade in a range of $2.00/MMBtu to $3.50/MMBtu. Given producer discipline, $2.00/MMBtu has triggered production curtailments and has acted to put a floor on prices. Prices above $3.50/MMBtu have led utilities to switch from burning natural gas to burning coal. This natural gas-to-coal switching acts to dampen natural gas prices—at the extreme, when gas prices soar to $7-$9/MMBtu, industrial demand weakens.

Marginal cost of supply is about $3.50/MMBtu. Toby estimates that producers in the Haynesville (a dry gas basin) need at least $3.50/MMBtu for cash flow breakeven. To earn a 10% return on its enterprise value, this requires another $1.00/MMBtu (or about a $4.50/MMBtu natural gas price).

Regarding the potential impact of the Presidential election, Toby noted that energy prices tend to be higher under Democratic leadership.

EQT’s Five-Year Accomplishments

Production has increased by over 50% from 4 billion cubic feet equivalent (Bcfe) per day to 6.3 Bcfe per day.

Free cash flow breakeven has been reduced from $3 per million Btu (MMBtu) to $2.00/MMBtu and could move even lower following the integration of ETRN.

Normalized for natural gas prices (i.e., $3.50/MMBtu), free cash flow generation has increased five times and free cash flow per share by nearly two times.

EQT—The Premier American Natural Gas Company

Notes: 1. Equity value calculated as of July 22, 2024, based on preliminary estimates of the maximum number of shares to be issued to Equitrans shareholders in connection with closing EQT’s acquisition of Equitrans. 2. Unlevered FCF breakeven is defined as the average Henry Hub price needed to generate positive unlevered free cash flow (a non-GAAP measure).

Source: EQT Investor Presentation – Second Quarter 2024 Results – July 23, 2024

INDUSTRIAL LOGIC BEHIND BECOMING VERTICALLY INTEGRATED THROUGH EQUITRANS ACQUISITION

In July, EQT reconsolidated with ETRN. Management dubbed it as putting “Humpty Dumpty back together again” and highlighted the merits of the acquisition:

o Results in significant base case cost synergies of $250 million identified with potential upside to $425 million

o Lowers free cash flow breakeven natural gas price from ~$3.00 to ~$2/MMBtu

o Reduces the need to hedge and allows greater participation to the rise in natural gas prices

o Enhances depth of drilling location inventory and extends terminal value

o Eliminates minimum volume commitments and adds operational flexibility

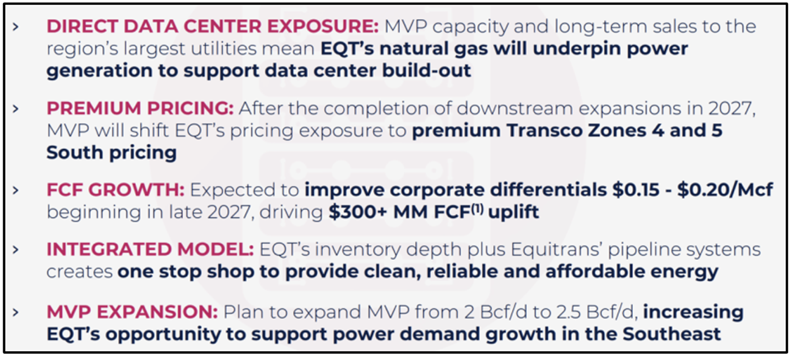

o Provides access to the build-out of data centers and growing Southeast markets via ownership of a 47% interest in the Mountain Valley Pipeline

MVP Provides Unique Access to Premium Southeast Region

Source: EQT Investor Presentation – Second Quarter 2024 Results – July 23, 2024

EQT’s Solid Capital Allocation Plans

1. Reduced debt. The plan is to reduce debt from $13.5 billion with the closing of the ETRN transaction to ~ $7.5 billion by the end of 2025 and lower thereafter ($5-$7.0 billion). This will be accomplished by selling non-operated upstream assets and minority interest in a Midstream Holdco (see below), and free cash flow.

2. Increased dividends. EQT currently pays an annual dividend of $0.63 per share (1.9% yield). Similar to large integrated oil and gas companies, management envisions a dividend yield of ~3% and steady annual dividend increases. A dividend increase seems likely before year end 2025.

3. Stock buybacks. The company will pursue optimistic buybacks after reducing debt.

EQT’S Low-Cost Structure Is a Competitive Advantage and Mitigates Need to Hedge

1. EQT has about 50% of its production hedged through 2025 at an average price of $3.25/MMBtu.

2. Low-cost structure mitigates the need to hedge. As noted, EQT’s cash flow breakeven cost is $2.00/MMBtu and well below its peers. At $2.75/MMBtu, management estimates that it can generate ~$1.5 billion in free cash flow.

Less hedges enable EQT to more fully participate in higher natural gas prices while its balance sheet is protected by a lower cost structure.

MOUNTAIN VALUE PIPELINE (MVP) STATUS:

Creation of a Midstream Holdco. Management is contemplating the creation of a midstream holding company (Holdco) that will house its interest in MVP and the Hammerhead Pipeline, and other regulated assets. As proposed, the Holdco will generate about $700 million in annual EBITDA. A multiple of 10 to 12x would equate to a valuation of $7 to $8.4 billion! (EQT will remain operator of MVP)

Expansion of MVP capacity. Currently, MVP can transport up to 2 Bcf/d of natural gas. EQT has about 1.2Bcf/d (60%) of capacity on the pipeline. At a relatively low cost, compression can add about 0.5 Bcf/d of capacity to MVP. However, additional natural gas transportation requires that Transco, (owned by the Williams Company) complete its Southeast Supply Expansion project. The Transco project is not expected to be in service until year end 2027.

AUGUST REVIEW: ENERGY SLIDES BACK

The rundown:

In August, SAM’s Infrastructure Income Portfolio produced a return (net of fees) of 3.9% compared to 2.4% for the S&P 500 and 4.2% for its customized benchmark as of 8/30/24. Year-to-date, SAM’s Infrastructure Income Portfolio produced a return (net of fees) of 23.6% compared to 19.5% for the S&P 500 and 19.2% for its customized benchmark as of 8/30/24.

In August, SAM’s Energy Transition Portfolio generated a return (net of fees) of 1.3% versus 3.1% for its customized benchmark as of 8/30/24. Year-to-date, SAM’s Energy Transition Portfolio generated a return (net of fees) of 10.9% versus 9.1% for its customized benchmark as of 8/30/24.

Midstream was up in August with a total return of 5.0%, as measured by the Alerian Midstream Energy Index (AMNAX).

In August, utilities and the clean energy sector underperformed, generating a total return of 4.6% and 1.3%, as measured by the Philadelphia Stock Exchange Utility Index (XUTY) and the S&P Global Clean Energy Index (SPGTCLTR), respectively.

With the exception of energy and consumer discretionary, all sectors in the S&P 500 reported a positive performance with consumer staples as the best performer and energy as the worst. Energy delivered a -1.7% monthly total return. August month-end WTI crude oil and Henry Hub natural gas prices were $74.52 Bbl and $1.93 per MMBtu, down ~6% and ~1%, respectively from last month.

RESULTS: SINCE INCEPTION & ONE YEAR

SAM’s Infrastructure Income Portfolio produced a return (net of fees) of 101.9% and 23.4% for the periods since 11/10/20 inception and 1-year, respectively. This compares to a total return of 98.0% and 23.5%, respectively, for its customized benchmark and 68.9% and 27.1%, respectively, for the S&P 500 as of 8/30/24.

SAM’s Energy Transition Portfolio generated a return (net of fees) of 11.8% and 6.6% for the periods since 4/29/21 inception and 1-year, respectively. This compares to a total return of 16.5% and 10.9%, respectively, for its customized benchmark and 41.2% and 27.1%, respectively, for the S&P 500 as of 8/30/24.

2024 Year-To-Date Total Return

Source: Bloomberg, NASDAQ and S&P Global

Sam Partners’ Infrastructure Income and Energy Transition Strategies seek to provide sustainable income and growth with capital preservation. This is accomplished by investing in a concentrated portfolio of high-quality midstream energy companies, utilities and clean energy companies that are well positioned to participate in the energy transition to a net zero carbon future. A diversified approach to investments across these sectors should optimize risk-adjusted returns, in our view. Our Infrastructure Income Strategy offers investors a current yield of ~4.0% and growth potential of ~5-7%; while the Energy Transition Strategy that is more heavily weighted with clean energy stocks and aligns with favorable ESG ratings, offers investors a current yield of greater than 4%. In a world searching for yield, we believe these Strategies offer a compelling value proposition.

Sam Partners’ Infrastructure Income and Energy Transition Strategies seek to provide sustainable income and growth with capital preservation. This is accomplished by investing in a concentrated portfolio of high-quality midstream energy companies, utilities and clean energy companies that are well positioned to participate in the energy transition to a net zero carbon future. A diversified approach to investments across these sectors should optimize risk-adjusted returns, in our view. Our Infrastructure Income Strategy offers investors a current yield of ~4.0% and growth potential of ~5-7%; while the Energy Transition Strategy that is more heavily weighted with clean energy stocks and aligns with favorable ESG ratings, offers investors a current yield of greater than 4%. In a world searching for yield, we believe these Strategies offer a compelling value proposition.

IMPORTANT DISCLOSURES

Siegel Asset Management Partners is a registered investment adviser located in Plainview, New York. The views expressed are those of Siegel Asset Management Partners and are not intended as investment advice or recommendation. This material is presented solely for informational purposes, and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness, or reliability. All information is current as of the date of this material and is subject to change without notice. Third-party economic, market or security estimates or forecasts discussed herein may or may not be realized and no opinion or representation is being given regarding such estimates or forecasts. Certain products and services may not be available in all jurisdictions or to all client types. Unless otherwise indicated, Siegel Asset Management Partners' returns reflect reinvestment of dividends and distributions. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

Comments